India’s Private Equity Landscape

Articles

India’s Private Equity Landscape.

Introduction:

The pace of growth of the economy, degree of professionalism, and favorable policies, all contribute toward growing confidence in the Investment opportunities in Indian companies, by local and foreign investors alike. As expected by analysts, the country’s contribution to global GDP is expected to rise sharply in the decade, which as of now stands at roughly 7%. This is because of the estimations put forth by the World Bank for Indian GDP to rise to approximately USD 5trillion, which stands at USD 2.95 trillion now.

The dedicated efforts of the government aim at “Atma Nirbhar Bharat”, by boosting entrepreneurship in the country. There are various schemes put forth to accomplish these objectives, for instances Startup India and Invest India. These Schemes provide a conducive ecosystem to the businesses in the country and put forth a path of growth and development.

The technical know-how of the skilled labor of the country and the pandemic-led evolution of digital trends are all contributing factors to the scope of growth for the country. Government efforts coupled with business owners’ willingness to adapt have created an environment that attracts investments. The same becomes apparent if we follow the degree of rising in India’s ranking in the list depicting countries with “Ease of Doing business”.

India and Private Equity

The last decade was the period when Private Equity – Venture Capital Investment started taking some solid shape. The quantum of investment by this segment stood at roughly USD 7.9 billion, which grew to approximately (Venture capital and Private Equity) of USD 77 billion in 2021. Below-mentioned images depict the mix of private equity investment trends in 2021.

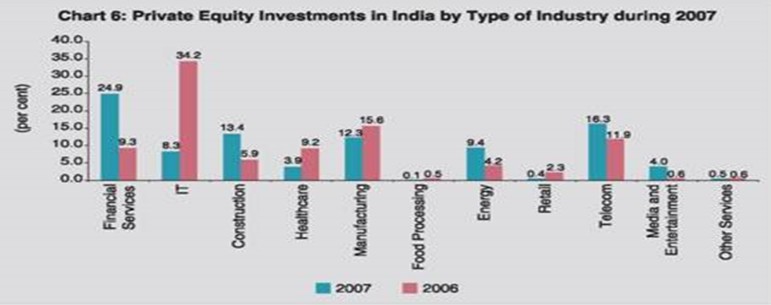

If we see the same in contrast with the trends in the year before, we will be able to understand how the shift is indicating the growth of the industry in the country, with total Private Equity investment standing at USD 13.26 Billion and Industry trend then is represented by the figure below.

Source: https://www.rbi.org.in/Scripts/bs_viewcontent.aspx?Id=2109

Factors that lead to such a massive growth of the Private Equity landscape in India:

Changes in Management Style: The growth of Private Equity in India can be attributed to the change in the management style of the business. The family-run businesses are now either run by a new generation that has exposure to a global business atmosphere or run by highly qualified professionals, with major stakeholders enjoying the rewards of the well-run companies. These factors make the businesses look attractive in the qualitative valuations and thus attract increased investments.

Entrepreneurship: With proper motivation and incentives, the young bright minds in the country are moving towards venturing into their enterprises. The hindrances that people faced earlier was that of funds, with various platforms available and developing skills of Indian professionals to properly pitch their ideas has led to increased confidence in the investors as well.

Globalization effect: The international entrants are giving tough competition to already existing businesses in India. Many of the private businesses in India did not run at par with the degree of professionalism the international businesses are run, which led to inefficiency. With foreign players tightening the competitive scenario, many such enterprises had to question their feasibility. Some of them have to get out of the business which led to a scenario of buyouts, acquisitions, and fund requirements, thus a positive push for the Private Equity investors.

Exit Policy: With Indian regulators creating a conducive environment for the private equity business by easing out the exit norms has contributed to the growth of the industry in the country.

Let us have a look at Private Equity in the major cities of India:

Private Equity in New Delhi:

The investors from New Delhi have welcomed Private equity investment opportunities across the segments and stages of the company. Here the Investments are done in startups as well as established enterprises.

Number of Private Equity firms in New Delhi: 138

Approximate amount of Investment done recently: USD 1.9 Billion

Hub’s Unicorn: BharatPe The startup, which is based in New Delhi, raised the new round at a post-money valuation of $2.85 billion, making it the 19th unicorn in 2021.

Private Equity in Mumbai:

Mumbai the financial capital of India has more professional investors, the tendency for Private Equity investors to have a more diverse range in Mumbai. Mumbai is also a hub for many regional offices of the world’s leading Private Equity firms. Mumbai also shares Delhi’s range of investments as well.

Number of Private Equity Firms: 73

Approximate amount of Investment done recently: USD 1.3 Billion

Hub’s Unicorn: Showing the diversity of Mumbai investments, Dream 11, a Mumbai-based gaming startup, joined the unicorn club in 2019, with funding of $60 million. The sports platform has joined the elite club of privately-held startups valued at $1 billion or more, making it India’s first gaming company to reach there.

Private Equity in Hyderabad:

Despite being a latecomer to the startup scene, Hyderabad has emerged as a key hub during the last 6 years, with over 6,600 startup companies in a variety of industries, with a few of them on the verge of unicorn level. The startup capital of the world. The state’s strong economy, good infrastructure, strong IT/ITES, pharma, and life sciences industries, presence of numerous research organizations, vast talent pool, relatively low real estate prices, and entrepreneur-friendly policies have all contributed to Hyderabad’s rapid rise as a major startup hub. A startup-friendly Private Equity location.

Number of Private Equity Firms: 94

Approximate amount of Investment done recently: USD 217 Million

Hub’s Unicorn: Darwinbox has registered funding of roughly Rs 537 crore, bringing its worth to over $1 billion.

Private Equity in Chennai:

For Startups, Chennai has remained elusive for its conservative approach and reclusive viewpoint. The city, in south India, is immersed in its cultural and societal norms. With the IIT Madras setting up, Chennai became an attractive destination for Private Equity investors and Startups alike.

Number of Private Equity Firms: 91

Approximate amount of Investment done recently: USD 1.8 Billion

Hub’s Unicorn: CredAvenue, the Chennai-based fintech startup, which connects enterprises with banks and other lenders, is also from the unicorn club.

Private Equity Firms in Bengaluru:

Bengaluru has always been the hottest destination for Private Equity and startups. It is attributed to the good connectivity of the city, bright talent, education quality, and suitable infrastructure. Investors are open to various startups in the region owing to decade long track of the region.

Number of Private Equity Firms: 197

Approximate amount of Investment done recently: USD 5.9 Billion

Hub’s Unicorn: BYJU, the Bengaluru-based ed-tech startup, is one of the many unicorns of the Hub.

Note: A unicorn is a privately held company with a market valuation of more than $1 billion.

Final thoughts:

Private Equity in India is set to grow by leaps and bounds, and India has immense potential. The changes in approach from monopolistic to consumer-centric will lead to deeper market penetration by industries, this, in turn, will keep funding an ongoing need. The conducive environment and policies will also keep the startup culture growing. The international firms are expanding their bases to India, as it is clear that geographical presence and expertise also play a crucial role in Private Equity. The number of private equity firms within India has grown tremendously, and very soon we are likely to see a unicorn among them as well.